Individuals with poor credit can access quick cash through title loans for cars, an alternative financing method using vehicle titles as collateral, avoiding strict credit checks. The process involves applying, providing documents, and agreeing to a lien on the car title until repayment. While risky if not managed well, these loans offer flexible terms, allowing timely payments to improve credit scores and keeping vehicle ownership intact.

“Struggling with poor credit and in need of a quick financial boost? Title loans for cars could offer a viable solution. This article explores an alternative financing option, providing insight into understanding title loans, their eligibility criteria for individuals with poor credit, and the potential benefits and considerations.

Learn how you can leverage your vehicle’s equity to gain access to much-needed funds, despite credit challenges. We’ll guide you through the process, helping you make informed decisions regarding this type of loan.”

- Understanding Title Loans for Cars

- Eligibility and Requirements for People with Poor Credit

- Benefits and Considerations of Using Title Loans

Understanding Title Loans for Cars

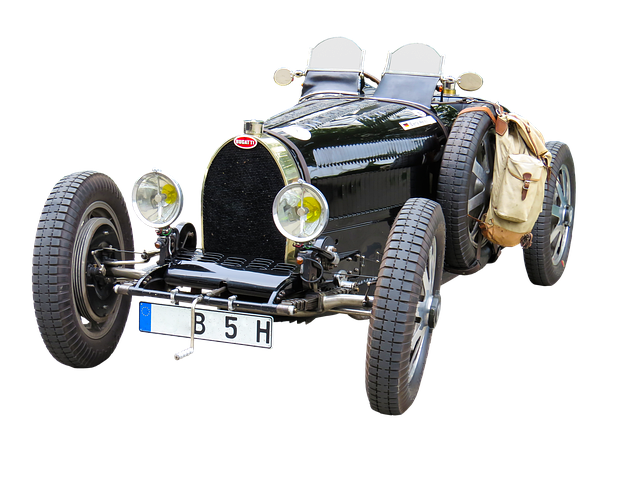

Title loans for cars have emerged as a popular option for individuals seeking financial assistance despite having poor credit. Unlike traditional loans that rely heavily on credit checks, these loans use the title of your vehicle as collateral. This alternative approach allows borrowers with limited credit history or low scores to access much-needed funds quickly. The title loan process involves several simple steps: applying for the loan, providing necessary documents, and allowing the lender to place a lien on your car’s title until the debt is repaid.

While this type of loan can be advantageous for those in urgent need of financial support, it’s important to understand the implications. The primary risk lies in the potential loss of one’s vehicle if unable to meet repayment terms. Therefore, borrowers should carefully consider their ability to repay the loan without jeopardizing their primary means of transportation or facing further financial strain.

Eligibility and Requirements for People with Poor Credit

When it comes to eligibility for title loans for cars, even individuals with poor credit or no credit history can find relief. Lenders who specialize in this type of financing often have more flexible criteria compared to traditional banks or credit unions. The primary focus is on the value and condition of your vehicle rather than your credit score. To qualify, applicants typically need a valid driver’s license and proof of vehicle ownership, which involves completing a simple vehicle inspection process. This inspection ensures that the car meets certain standards and has enough equity to secure the loan.

While specific loan requirements may vary between lenders in Houston or other cities, generally, you must be at least 18 years old, have a stable source of income to make repayments, and be willing to hand over your vehicle’s title as collateral for the duration of the loan. It’s important to remember that even with poor credit, maintaining timely payments can help improve your credit score over time. Houston Title Loans providers understand that life happens, so they usually offer flexible repayment plans tailored to individual needs.

Benefits and Considerations of Using Title Loans

For individuals with poor credit, exploring options for financial assistance can be a challenging yet necessary step. Title loans for cars have emerged as a viable solution, offering a unique approach to securing loans without the stringent requirements often associated with traditional banking. This alternative financing method allows borrowers to use their vehicle’s title as collateral, providing them with quick access to cash.

One of the key benefits of title loans is the flexibility they offer. Loan terms are typically structured to accommodate borrowers’ needs, allowing them to keep their vehicle during the repayment period. This ensures continued transportation and mobility while managing financial obligations. Moreover, the process is often faster and more accessible than conventional loan options, making it an attractive choice for those seeking immediate financial relief. By leveraging their vehicle’s equity, individuals with poor credit can gain the necessary financial assistance to cover unexpected expenses or consolidate debt.

Title loans for cars can be a viable option for individuals with poor credit seeking quick funding. By leveraging their vehicle’s equity, borrowers can access cash without strict credit checks. While this alternative financing method offers benefits like fast approval and flexible terms, it’s essential to consider potential drawbacks such as interest rates and the risk of repossession. Thoroughly understanding the eligibility requirements and thoroughly evaluating the pros and cons will help ensure a well-informed decision when considering a title loan for your vehicle.