Title loans for cars offer a swift funding solution, leveraging vehicle titles as collateral for higher loan amounts with less stringent requirements. However, these loans carry significant risks, including repossession and high-interest rates upon default. To protect oneself, borrowers must meticulously understand terms, fees, and potential consequences, practicing responsible borrowing by adhering to repayment schedules and seeking support when facing financial hardships.

Title loans for cars can provide quick cash, but they come with significant risks. This article delves into the intricacies of these agreements, offering a comprehensive overview of “Understanding Title Loans for Cars.” We explore the potential pitfalls and severe consequences of default, guiding you through strategies to protect yourself. By understanding these risks, borrowers can make informed decisions and mitigate potential financial disasters associated with title loans for cars.

- Understanding Title Loans for Cars: A Comprehensive Overview

- Potential Risks and Consequences of Default

- Protecting Yourself: Strategies to Mitigate Title Loan Risks

Understanding Title Loans for Cars: A Comprehensive Overview

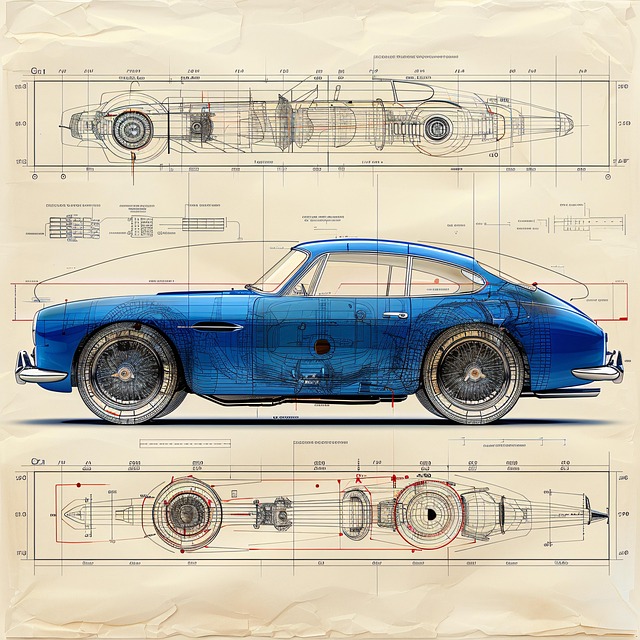

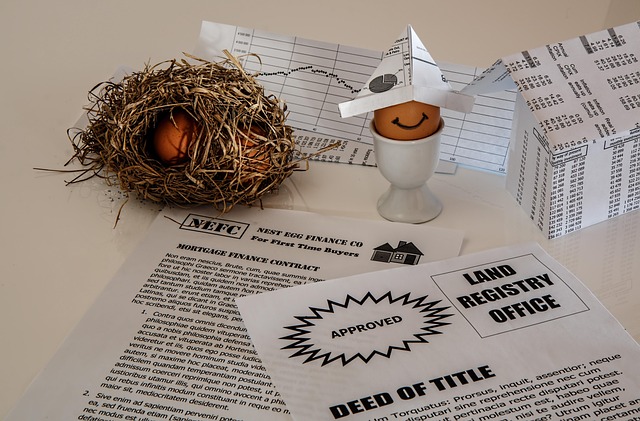

Title loans for cars have gained popularity as a quick source of funding for individuals needing cash fast. This lending option involves using your car’s title as collateral, allowing lenders to offer relatively higher loan amounts compared to traditional personal loans. The process is straightforward; borrowers provide their vehicle’s title to the lender, who then holds it until the loan is repaid. This type of loan is particularly appealing to those with poor credit or a need for immediate funds, as it often requires minimal documentation and offers faster approval times.

In this arrangement, borrowers benefit from flexible repayment options, which can be structured to fit their financial capabilities. Unlike standard loans with strict monthly payments, title transfer allows for more adaptability. Repayment plans can be tailored, offering either a lump-sum payment or flexible payments over an extended period. This flexibility makes it accessible to various income levels, ensuring borrowers can manage their finances without the added strain of rigid repayment terms.

Potential Risks and Consequences of Default

When entering into a title loan for cars agreement, it’s crucial to be aware of the potential risks and consequences should a default occur. One of the primary dangers is the possibility of losing your vehicle. If you fail to repay the loan as per the agreed-upon terms, the lender has the legal right to repossess your car. This can leave you without transportation, which might impact your daily life and work commitments.

Moreover, defaulting on a title loan can lead to significant financial strain. Lenders often charge high-interest rates, and if the debt remains unpaid, additional fees and penalties may apply. This can create a vicious cycle, making it increasingly difficult to get back on track financially. It’s essential to consider these risks and understand your repayment obligations before opting for a title loan through an online application or during a convenient vehicle inspection.

Protecting Yourself: Strategies to Mitigate Title Loan Risks

When considering a title loan for your car, protecting yourself from potential risks is paramount. The most significant advantage of these loans is their fast cash availability, but it’s crucial to understand the associated perils. One strategic approach to mitigate these risks is to ensure you fully comprehend the terms and conditions of the loan agreement. Always ask about interest rates, repayment schedules, and any hidden fees upfront. Keeping your vehicle is another vital aspect; title loans allow you to retain possession, unlike traditional car loans that may require surrendering the vehicle. This can be a significant advantage, providing financial flexibility while ensuring you have a means of transportation.

Additionally, being proactive about loan management can help minimize problems. Making timely payments and adhering to the agreed-upon schedule can prevent default penalties. Should you encounter financial difficulties, communicate with your lender as early as possible. They might offer solutions like loan extensions, which could provide some breathing room without accumulating excessive charges. Remember, while fast cash is enticing, informed decisions and responsible borrowing practices are essential strategies to protect yourself from the risks associated with title loans for cars.

Title loans for cars can provide quick cash, but it’s crucial to understand the risks involved. By grasping the potential consequences of default and employing strategies to protect yourself, you can make an informed decision. Navigating these agreements with caution is essential to avoid financial pitfalls. Remember that while title loans may offer a temporary solution, they can significantly impact your future if not managed responsibly.