Title loans for cars provide quick cash access using your vehicle's title as collateral. Suitable for those with poor credit or limited banking, these loans allow borrowers to keep their vehicles while making fixed monthly payments. Eligibility requires being at least 18 with a valid driver's license, proof of ownership, and alternative credit verification. The simple process involves researching reputable lenders, gathering essential documents, and applying online.

Looking for a quick financial fix? Title loans for cars offer an accessible solution. This comprehensive guide unravels the process, from understanding the basics of these secured loans to mastering the application criteria and steps. We break down everything you need to know to navigate this alternative financing path effortlessly. By the end, you’ll be equipped to make an informed decision and access funds swiftly.

- Understanding Title Loans for Cars: Basics Explained

- Eligibility Criteria: What You Need to Know

- Applying Step-by-Step: A Simple Guide

Understanding Title Loans for Cars: Basics Explained

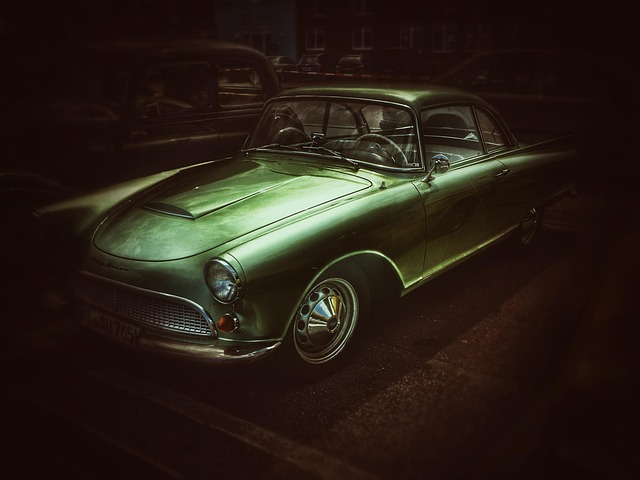

Title loans for cars are a quick way to access cash using your vehicle’s title as collateral. This type of loan is ideal for individuals who need immediate funds but may have poor credit or limited options for traditional banking services. Unlike a conventional car loan, with a Title Pawn, you retain possession of your vehicle while making fixed monthly payments to repay the borrowed amount plus interest.

Understanding the process involves familiarizing yourself with Loan Requirements. These typically include providing proof of ownership, a valid driver’s license, and a clear title. Once approved, the lender will issue a direct deposit into your bank account, allowing you to cover unexpected expenses or pursue opportunities without delay.

Eligibility Criteria: What You Need to Know

When considering a title loan for cars, understanding your eligibility is the first step to securing the funds you need. Most lenders have basic criteria in place to ensure responsible lending practices, but each lender may vary slightly. Typically, borrowers must be at least 18 years old and have a valid driver’s license. Proof of vehicle ownership is another crucial requirement, which involves providing the title to your car as collateral for the loan. This ensures that the lender has security in case of default.

Additionally, while many lenders do not perform a no credit check process, they may consider alternative forms of credit history and income verification. Some even accept online applications, making the initial application quick and convenient. During this stage, you’ll need to supply personal information, vehicle details, and possibly employment records to demonstrate your ability to repay the loan.

Applying Step-by-Step: A Simple Guide

Applying for a Title Loan for Cars is a straightforward process that can help you access fast cash using your vehicle as collateral. Here’s a simple, step-by-step guide to make it easier:

1. Research and Choose a Lender: Start by researching different lenders in your area or online. Look for reputable companies with positive reviews and clear terms. You want a lender that offers flexible payment plans tailored to your budget.

2. Gather Necessary Documents: Before applying, ensure you have all the required documents. These typically include: a valid driver’s license or ID, proof of vehicle registration and insurance, and a clean title for your car (no outstanding loans on it). If you have any previous financial records related to similar loans, those can also be helpful.

Title loans for cars can be a convenient option for those in need of quick cash. By understanding the basics, knowing your eligibility, and following a simple application process, you can access funds leveraging your vehicle’s title. Remember, while this can provide relief, it’s a secured loan with potential consequences if not repaid, so always weigh the benefits and risks carefully.