Title loans for cars are flexible financial solutions often overlooked due to misconceptions. Contrary to belief, these loans aren't just for dire situations and bad credit; they cater to borrowers with stable incomes but unexpected expenses. By assessing vehicle equity, lenders provide accessible short-term funding with competitive rates and flexible payment plans. Reputable lenders offer a reliable tool for debt consolidation or emergencies, empowering individuals to manage their finances effectively without harsh terms or losing vehicle ownership.

“Unraveling the myths surrounding title loans for cars is essential for anyone facing urgent financial straits. Many believe these loans are a desperate measure, but the reality offers a refreshing alternative. This article aims to guide you through the misconceptions, revealing the truth about interest rates and flexible terms. We’ll also compare title loans with other short-term options like payday advances, personal loans, and credit cards, empowering you to make informed decisions when facing unexpected financial challenges.”

- Debunking Common Misconceptions About Title Loans for Cars

- – Addressing the perception of title loans as a last resort

- – Clarifying the reality and potential benefits for urgent financial needs

Debunking Common Misconceptions About Title Loans for Cars

Many people have misconceptions about title loans for cars, leading them to avoid this potential financial solution altogether. It’s essential to understand that these loans are not one-size-fits-all; they offer a flexible payment plan tailored to your needs. One common myth is that title loans are only suitable for those in dire financial straits, but the truth is, many individuals use these loans for debt consolidation or to cover unexpected expenses. This option provides them with the liquidity needed to manage their finances effectively.

Another misconception is that title loans come with exorbitant interest rates and harsh terms. While it’s true that interest rates can vary, responsible lenders offer competitive rates and flexible payment plans. These loans allow you to retain your vehicle, providing a sense of security compared to traditional secured loans. By understanding the facts and choosing reputable lenders who prioritize customer satisfaction, individuals can leverage title loans for cars as a strategic tool for financial management without falling into debt traps.

– Addressing the perception of title loans as a last resort

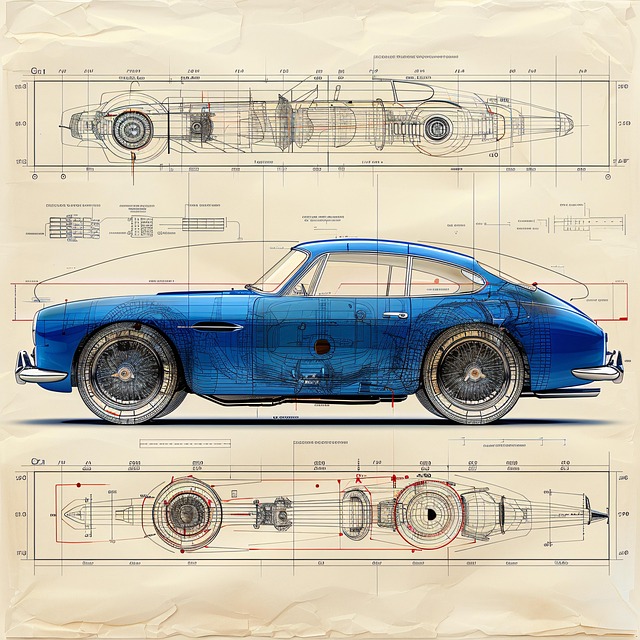

Many people view title loans for cars as a desperate measure, a last resort when all other options have failed. This misconception needs to be addressed, as title loans can offer a viable solution for individuals seeking quick funding. It’s essential to understand that vehicle ownership provides a unique opportunity for leveraged borrowing. By using the equity in your car, you gain access to cash without selling or sacrificing full ownership.

This alternative financing method is particularly appealing for those with stable income but unexpected financial burdens. With flexible payment plans and varied repayment options, title loans can be tailored to individual needs. Unlike traditional loans that may require impeccable credit, these loans focus on the value of your vehicle, making them accessible to a broader range of borrowers.

– Clarifying the reality and potential benefits for urgent financial needs

Title loans for cars have gained popularity as a quick solution to urgent financial needs. However, many myths surround this option, leading individuals to make uninformed decisions. It’s essential to clarify that title loans can be beneficial when used responsibly. These short-term loans allow car owners to access a portion of the value of their vehicle, providing immediate cash flow for unexpected expenses or emergencies.

One common misconception is that only those with perfect credit qualify for title loans. While having good credit can improve loan eligibility, many lenders offer flexible requirements. Even individuals with less-than-perfect credit history can apply for semi truck loans or other types of automotive financing. Lenders often consider the overall value and condition of the vehicle more than the borrower’s credit score when assessing loan requirements. This makes title loans accessible to a wider range of people facing financial crises, ensuring they have options during challenging times.

Title loans for cars have often been shrouded in myth, but understanding their true nature can empower individuals to make informed decisions during financial emergencies. By dispelling the notion that these loans are solely for desperate situations, we uncover a valuable option for those seeking quick access to cash. Title loans, when used responsibly, can provide a reliable solution for urgent financial needs, offering flexibility and convenience. So, if you’re considering a title loan, remember: it’s not just about a last resort; it’s about having another tool in your financial toolbox.