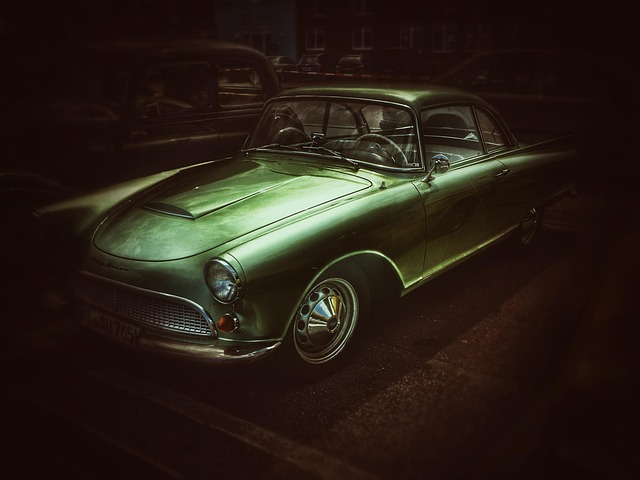

Title loans for cars provide quick financial relief in Houston, utilizing vehicle titles as collateral. Unlike traditional bank loans, these loans focus on vehicle equity rather than credit score, making them accessible to borrowers with less-than-perfect histories. Reputable lenders like Houston Title Loans offer swift approval and quick funding (often within one business day), allowing borrowers to retain vehicle ownership while repaying the loan, thus avoiding high-interest traps during financial emergencies.

“Unraveling the mysteries of title loans for cars, we break down common myths and misconceptions into clear, understandable facts. In today’s financial landscape, understanding short-term loan options is crucial, especially when it comes to securing fast cash using your vehicle’s title as collateral. This article guides you through the basics of title loans for cars, explaining how they work and dispelling popular myths, so you can make informed decisions regarding this alternative financing option.”

What Are Title Loans for Cars?

Title loans for cars are a type of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This financial solution allows individuals who own a car and have a clear title to access quick cash, often with less stringent requirements compared to traditional bank loans. The process involves a simple application, where lenders assess the vehicle’s value, typically through a brief inspection, and offer a loan amount based on that assessment.

In Houston, title loans have gained popularity as a fast and convenient financial solution for those in need of immediate funds. Unlike other types of car loans, these do not require a lengthy credit history or perfect credit scores. Instead, the primary focus is on the vehicle’s equity, ensuring a faster approval process. Once approved, borrowers retain possession of their vehicle but must adhere to the terms of the loan, including timely payments, to avoid potential title transfer issues.

Common Misconceptions Debunked

Many people have misconceptions about title loans for cars, often due to lack of understanding or misinformation from dubious sources. One of the most common myths is that these loans are inherently risky and lead to a cycle of debt. While it’s true that any loan carries some risk, responsible borrowing through reputable lenders can mitigate these concerns. Houston Title Loans, for instance, offers quick approval processes designed to provide relief during financial emergencies without trapping borrowers in a cycle of high-interest payments.

Another misconception is that title loans are only accessible to those with excellent credit. In reality, many lenders cater to a wide range of borrowers, including those with less-than-perfect credit. This is where the security of your vehicle comes into play; the loan is backed by the car’s title, not necessarily your personal credit score. This ensures that even if you have a poor credit history, you can still access funds quickly through a title pawn, allowing for better financial management and decision-making.

How Do Title Loans Work?

Title loans for cars have gained popularity as a quick funding option for those needing cash fast. But how do they work? It’s a straightforward process that involves using your car’s title as collateral. Here’s a breakdown: First, you initiate the process by applying through a lender who offers such services. After providing necessary documentation and verifying your identity, the lender will perform a vehicle inspection to assess its value. Once approved, you’ll receive your loan funds, typically within the same day or a few business days later. The key difference from traditional loans is that with title loans, lenders prioritize the car’s equity rather than your credit score, making them accessible even for those with less-than-perfect credit (no credit check required). This secured loan process allows borrowers to keep their vehicle during the repayment period.

Title loans for cars have been a topic of many misconceptions, but understanding how they work can help you make informed decisions. By debunking common myths and knowing the facts, you can see that title loans offer a viable option for short-term financial needs. These loans provide quick access to cash using your vehicle’s title as collateral, making them a popular choice for those seeking immediate funding. Remember, responsible borrowing is key, so always understand the terms and conditions before securing a title loan for cars.